Writing application materials can be tricky: adding a storytelling element requires a lot of material and personal biases.

* * *

It has been said that having a founder who continues to run a company is a wonderful bonus, but AMAT is an exception: two executive leaders who were brought in saved the company.

Most readers are probably reading the story of these three men from this perspective for the first time.

1. The Origin of Conspiracy Theories. Link to heading

The manufacture of chips requires a large amount of high-purity chemicals (semiconductor grade), which are usually toxic, flammable and explosive. There have been many incidents of fires in wafer factories, leading to various conspiracy theories that manufacturers deliberately caused them in order to control prices.

In the early days of Silicon Valley, most of those geniuses understood physics but not chemistry. They were very afraid of hazardous materials, so Mike was very popular. He had a good relationship with people like Moore and Noyce who were still in their infancy at the time.

At the age of 25, Mike ventured into chemical agency and later discovered the urgent need for specialized equipment in semiconductor processing of these materials (which were quite difficult to handle in various forms of solid, liquid, and gas). In 1967, three years later, he established Applied Materials (its name represents how to “apply” these chemical “materials”).

The angel investment for AMAT came from Mike’s father-in-law with only $7,500, followed by contributions from the Intel big three and others, totaling several tens of thousands dollars.

Mike and Robert Graham, the first sales representative of Intel at the time (referred to as Bob hereafter), co-authored a famous white paper that defined semiconductor wafer manufacturing, known as “fabrication,” as an emerging industry. This is believed to be the origin of the term Fab, commonly used to refer to semiconductor manufacturing plants.

“Bob is another main character in this text, but he will be discussed later on.”

2. Find Jim to put out the fire. Link to heading

At the time, large companies such as IBM, TI, and Motorola all manufactured their own equipment, while AMAT had almost no ability to enter the market. Its first device was a pipeline and control board for flammable silane gas. It wasn’t until 3-4 years later, when AMAT achieved infrared epitaxy and high-temperature deposition capabilities, that it began to catch the attention of major corporations. Deposition (CVD, PVD) also became AMAT’s main business in the later years.

Mike acknowledges himself as a scientist and admits he is financially illiterate. Although the company successfully went public, in the mid-1970s, due to diversifying into businesses such as silicon wafers, it coincidentally experienced a major recession in the industry, and the company almost went bankrupt.

In 1976, Mike recruited James Morgan, also known as Jim, from a venture capital company to come to the rescue.

Jim relied on his relationship with the bank to obtain debt extension while cutting off five out of six business units including silicon wafers to stop the bleeding, focusing solely on developing epitaxy and CVD (Chemical Vapor Deposition) equipment.

When Mike, who was still somewhat young at the time, asked Jim in his thirties to gradually step back from AMAT, there was a sense of yielding. But from another perspective, Mike was like Steve Jobs when he left Apple. Although Mike continued to start businesses consecutively, the industry no longer recognized his name and Jim did not give him the opportunity to return to AMAT where he had spent ten years.

Three, A Brief Gathering of Three Men. Link to heading

Originally, I thought that Jim, based on his name, was a member of the Morgan family, which would make for a story of a wealthy second generation. However, in reality, his family was a far-off farming family in Indiana that canned lima beans and corn.

During the Vietnam War, Jim studied mechanical engineering at Cornell University. He served two years supplying military equipment and was fortunate enough to complete his MBA. After working for several years in large companies, Jim decided to enter the venture capital industry and participated in numerous high-tech projects. He was recommended by someone to take a look at AMAT, which was in a difficult situation.

Mike continued to support Jim for a year after his appointment, and also hired Bob to assist Jim in sales. There are differing accounts of this period in history, but ultimately history is written by the victorious.

Three men are unanimous on two important principles: to provide excellent service for equipment and to expand their business overseas.

Although semiconductor manufacturing in the past did not involve as many as thousands of procedures as it does today, the basic process was similar. Each step involved a detailed procedure, and it was crucial to know how to use every piece of equipment correctly.

The dedication of AMAT to technology and attentive service has gradually caused proprietary equipment of those big factories to lose their competitiveness, after all developing technology for twenty customers is much more cost-effective than only doing so for one.

4. Fate in China. Link to heading

Back in the 1980s, AMAT was not a large company, and establishing overseas branches was very expensive. However, Jim and Bob recognized that semiconductor equipment selection was a long-term matter and that overseas operations could balance the risk of a single market. While many competitors cut back on overseas services during economic downturns, this weakened customer loyalty.

Thanks to its advanced CVD technology, AMAT has achieved great success in Japan, with Bob being a major contributor. Due to the importance of the Japanese market, AMAT later established a major business unit for LCD operations. LCD panel manufacturing can also be seen as a form of semiconductor manufacturing.

In Europe, there was once fierce competition between AMAT and ASM, but Jim’s full attention to overseas services kept ASM suppressed. At the earliest stage, ASM was also an agent of AMAT, but Mike soon discovered that the old Del Prado’s ambitions ended the cooperation.

It is unbelievable how early AMAT entered China. In 1983, Jiang Zemin, who was in charge of the Ministry of Electronics at the time, visited the United States and made a special trip to visit AMAT, where he had dinner with Jim.

In 1984, Jim returned to China to establish a joint venture company. This fully demonstrated the foresight and vision of these two legendary figures, as well as AMAT’s ground-level service concept. It should be noted that the 909 project was still a decade away at that time.

5. Modified history Link to heading

Next, let’s talk about Bob.

Bob also came from a poor town in Indiana, but he definitely surpassed those who just focus on doing homework. Bob can be considered as the pioneer of the semiconductor sales industry, from Fairchild to Intel. Later, his approach of selling chips was still widely used.

Bob was actually one of the co-founders of Intel, but Andy Grove felt that he was more handsome than him (my assumption) and forced Noyce to choose between them. Later on, Grove became famous for his paranoia and he erased Bob from the history of Intel.

(Bob’s wedding photo)

In the official history of AMAT, Bob’s contribution was also severely underestimated. Jim took all the credit for saving AMAT, perhaps due to Bob jumping ship to AMAT’s competitor Novellus as their CEO in 1986.

However, this is not a story of poaching. In fact, Bob sacrificed himself to save Novellus from collapsing, in order to prove that he was right.

Sixth, the dispute over technical roadmap. Link to heading

Novellus was founded in 1984 by several ex-employees of AMAT. They innovatively designed a multi-chamber CVD device that can handle 5 wafers simultaneously, greatly increasing production efficiency.

After the prototype design of Novellus was completed, all the money was spent.

Bob advised Jim to acquire Novellus, but his suggestion was rejected. Perhaps years later, Jim regretted not squashing this strong competitor, but he spoke of how competition propelled AMAT’s technological advancements.

Jim’s decision is not unreasonable, as he is very dedicated. Despite AMAT being so powerful, it has not touched backend business for many years, and all of their focus is on “applying” materials on wafers.

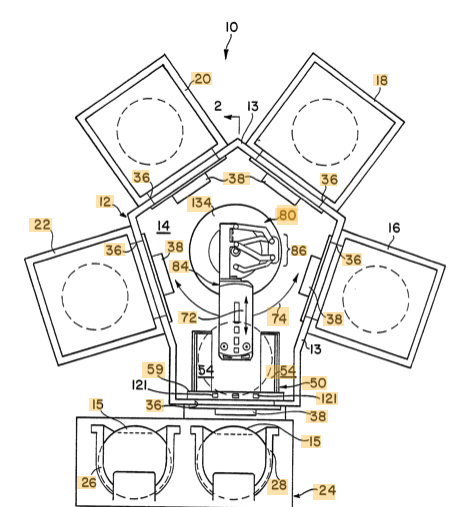

It is not Jim’s style to bet on both sides, and at that time, he chose the technical route of betting all on Precision 5000. Although it is also a multi-chamber machine, the classic pentagon design can cover 2-4 chambers. Unlike Novellus, P5000 can be used for a combination of deposition and etching. (P5000 patent diagram) Precision 5000 is indeed a groundbreaking product, forming the standard and discourse power of AMAT modularity.

Before the birth of P5000, wafers were often moved between different processes by human labor, which made them highly susceptible to contamination. Precision has now achieved the use of robotic arms to transport wafers between various enclosed chambers.

Later, the Endura 5500, a similar concept, featured as many as eight high vacuum chambers and has been the dominant force in the PVD industry since 1990. The main difference between PVD (physical vapor deposition) and CVD is that PVD involves no chemical reaction and is usually used for depositing metal layers.

7. Bob’s counterattack. Link to heading

Comrade Bob, who led Novellus, successfully infiltrated the booming Japanese manufacturer with his own social status and Japanese connections. By 10 years later, all major semiconductor factories possessed Novellus equipment.

AMAT and Novellus have become arch rivals in the field of CVD. AMAT has repeatedly filed patent infringement lawsuits against Novellus while Novellus has allied with Lam Research to provide a complete solution of deposition and etching.

Deposition (D) and etching (E) are a complementary set of processes: deposition is responsible for laying down a thin film, while etching removes portions that should not be covered by the film. An aspect of advanced processes is that ion E can be used instead of ion D, and atom E can be used instead of atom D.

The collaboration of Lam and Novellus is a force to be reckoned with.

In 2011, Lam announced its merger with Novellus (Lam acquired 3.3 billion shares equivalent to a 6:4 merger), narrowing AMAT’s revenue gap.

As the king of memory devices, new Lam is continuously approaching AMAT’s throne due to the great development of 3D NAND and other technologies. As a countermeasure, in 2013, AMAT announced the acquisition of Tokyo Electron (TEL), which is of a similar size to Lam.

8. AMAT’s Ambition and Caution Link to heading

AMAT is the leader in sedimentation and the second in conductor etching, while TEL’s CVD is also very strong and its advantages, such as coating and dielectric etching, are highly complementary to AMAT. The merger of AMAT and TEL will create a semiconductor equipment giant larger than the sum of the second, third, and fourth places, which is causing concern for many chip factories, as negotiations will become more difficult.

In 2015, US regulatory agencies refused AMAT’s acquisition on anti-monopoly grounds. The following year, LAM’s acquisition of KLA was also rejected, so let’s consider it a draw.

AMAT also attempted photolithography and even discussed acquiring GCA.

I mentioned during my talk about KLA that in the 1980s, AMAT bought Cobilt lithography from CV. Cobilt was like the West Point of the semiconductor equipment industry. Aside from KLA, ASM was also an early Cobilt European agent.

Philips had initially agreed to purchase Cobilt to secure a vendor code for their lithography machines in the US market. However, a last-minute change of heart by the board of directors resulted in Cobilt being sold off.

TEL took over Cobilt’s coating, developing, and wafer inspection business and remains dominant in those areas to this day. Jim’s purchase of Cobilt’s lithography business, however, was largely unsuccessful, and he quickly abandoned it after securing funding to pay off debts.

Due to his good relationship with the Japanese company, Jim chose to collaborate with Nikon and helped them enter the American market. Do you remember in “The Light-Sculpting Giant,” Jim urged ASML’s first CEO, Schmidt, to give up lithography?

From this, we can see that Jim is very cautious and risk-averse. He seldom engages in core business acquisitions, fearing to repeat past mistakes. It was only after Jim’s retirement that his successors began venturing into large-scale mergers and acquisitions.

I finished reading Jim’s autobiography in less than an hour. The writing style is very traditional, filled with management ideas and charitable content, yet it lacks substance. This is perhaps an indication of Jim’s steady style.

Nine, first-mover advantage. Link to heading

Have you noticed that traditional flagship products of semiconductor equipment companies (such as AMAT’s Epi and PVD, TEL’s Coater and Prober, LAM’s Plasma Etch, and ASM’s ALD) still maintain leading market shares in their respective niches despite long-term evolution? This is incredible for those of us who are accustomed to winning through price wars.

The reason is not that these types of devices are made perfectly or that competitors cannot make them. In fact, most devices have competing products. The particular aspect that sets these major companies apart is that they are not just making equipment, but rather, they provide a complete and mature process and integration capability for production lines.

The advantage of being the first to market allows large equipment manufacturers to confidently guarantee that semiconductor factories, with investments of billions of dollars from their clients, can operate 7x24 without interruption. This poses a significant challenge for newcomers, who often have to plead for equipment to be donated for trial use.

Semiconductor fabrication plants are perhaps the pinnacle of human technological achievement, as they require cutting-edge advancements in physics, chemistry, materials science, electronics, mechanics, and control software to function. The integration of these technologies and equipment into a stable and efficient production line, along with well-designed processes and support services, is absolutely crucial.